"Executive Summary Latin America Treasury Software Market :

CAGR Value

The Latin America Treasury Software Market report has been designed in such a way that it proves to be the most appropriate to the business needs. Moreover, this market report gives idea to clients about the market drivers and restraints with the help of SWOT analysis and also provides all the CAGR projections for the historic year, base year and forecast period. This Latin America Treasury Software Market study also evaluates the market status, market share, growth rate, future trends, market drivers, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The Latin America Treasury Software Market business report endows with an exhaustive overview of product specification, technology, product type and production analysis considering major factors such as revenue, costing, and gross margin. This market report also provides the list of leading competitors along with the strategic insights and analysis of the key factors influencing the industry. Latin America Treasury Software Market research study lends a hand to the purchaser in comprehending the various drivers and restraints with their effects on the market during the forecast period. The Latin America Treasury Software Market industry report comprises of primary, secondary and advanced information about the global market with respect to status, trends, size, share, growth, and segments in the forecasted

Discover the latest trends, growth opportunities, and strategic insights in our comprehensive Latin America Treasury Software Market report. Download Full Report: https://www.databridgemarketresearch.com/reports/latin-america-treasury-software-market

Latin America Treasury Software Market Overview

**Segments**

- By Component: Software, Services

- By Deployment Type: On-Premises, Cloud

- By Organization Size: Large Enterprises, Small and Medium-Sized Enterprises (SMEs)

- By Industry Vertical: BFSI, IT and Telecommunication, Retail, Healthcare, Government, Others

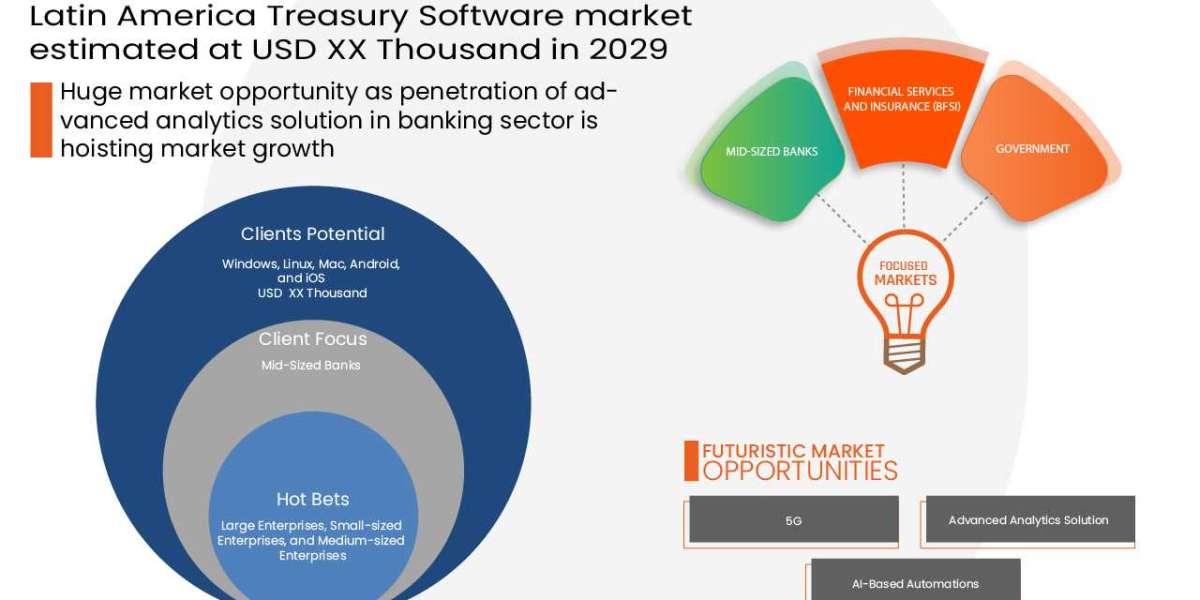

The Latin America treasury software market is segmented based on components, deployment types, organization sizes, and industry verticals. The component segment includes software and services, offering solutions for efficient treasury management. The deployment type segment comprises on-premises and cloud solutions, providing flexibility in accessing treasury software. In terms of organization size, the market is divided into large enterprises and small to medium-sized enterprises, catering to the varying needs of different businesses. Furthermore, the industry vertical segment covers sectors such as banking, financial services and insurance (BFSI), IT and telecommunication, retail, healthcare, government, and others, showcasing the diverse applications of treasury software across various industries.

**Market Players**

- FIS

- SAP SE

- Oracle

- Kyriba Corp.

- GTreasury

- ION Group

- Reval

- Bellin Treasury Services GmbH

- Sopra Banking Software

- Calypso Technology

Key market players in the Latin America treasury software market include FIS, SAP SE, Oracle, Kyriba Corp., GTreasury, ION Group, Reval, Bellin Treasury Services GmbH, Sopra Banking Software, and Calypso Technology. These companies offer advanced treasury software solutions to streamline financial operations, enhance decision-making processes, and optimize cash management for organizations in the region. With their innovative technologies and industry expertise, these players contribute significantly to the growth and development of the treasury software market in Latin America.

The Latin America treasury software market is experiencing significant growth due to various factors such as increasing digital transformation initiatives, rising demand for efficient cash and risk management solutions, and the need for automation in financial processes. One of the key drivers impacting the market is the increasing adoption of cloud-based treasury software solutions, enabling organizations to access advanced features and functionalities while reducing infrastructure costs. Moreover, the growing awareness among enterprises regarding the benefits of treasury software in improving operational efficiency and decision-making processes is driving market growth in the region.

In terms of industry verticals, the BFSI sector is anticipated to hold a significant market share in the Latin America treasury software market due to the high volume of financial transactions and the need for real-time visibility into cash positions. The IT and telecommunication sector is also expected to witness substantial growth as companies aim to optimize cash flow management and mitigate financial risks in a volatile market environment. Additionally, the healthcare sector is increasingly adopting treasury software solutions to streamline revenue cycle management and comply with regulatory requirements, further boosting market growth.

Key market players such as FIS, SAP SE, and Oracle are focusing on strategic initiatives such as mergers and acquisitions, partnerships, and product innovations to enhance their market presence and cater to the evolving needs of customers in Latin America. These companies are investing in advanced technologies like artificial intelligence and machine learning to offer predictive analytics and real-time insights for better decision-making processes. By leveraging their expertise and resources, these market players are expected to drive innovation and disrupt the traditional treasury management landscape in the region.

Furthermore, the competitive landscape of the Latin America treasury software market is characterized by intense rivalry among key players striving to gain a competitive edge through product differentiation and pricing strategies. Companies like Kyriba Corp., GTreasury, and ION Group are focusing on enhancing their product offerings to meet the specific requirements of different industry verticals and organization sizes. Additionally, partnerships with local vendors and regional expansion initiatives are key strategies adopted by market players to expand their market reach and enhance customer engagement in Latin America.

In conclusion, the Latin America treasury software market is poised for significant growth driven by technological advancements, increasing digitization, and the need for efficient financial management solutions across industries. With the presence of key market players and their relentless focus on innovation, the market is expected to witness a surge in demand for advanced treasury software solutions, leading to a more streamlined and optimized financial ecosystem in the region.The Latin America treasury software market is witnessing a notable surge in demand driven by several key factors. The increasing digital transformation initiatives across industries are compelling organizations to adopt advanced treasury software solutions to streamline financial operations, enhance decision-making processes, and optimize cash management. The rise in demand for efficient cash and risk management solutions is further propelling market growth, as companies seek to mitigate financial risks and ensure real-time visibility into cash positions. Moreover, the need for automation in financial processes is pushing organizations towards embracing treasury software to improve operational efficiency and drive overall performance.

In the competitive landscape, key market players like FIS, SAP SE, Oracle, and others are playing a pivotal role in shaping the market dynamics through strategic initiatives. These companies are focusing on mergers and acquisitions, partnerships, and product innovations to enhance their market presence and cater to the evolving needs of customers in Latin America. By investing in advanced technologies such as artificial intelligence and machine learning, these players are aiming to offer predictive analytics and real-time insights for better decision-making processes, thus driving innovation and disrupting the traditional treasury management landscape in the region.

The industry verticals within the Latin America treasury software market are witnessing varying degrees of adoption and growth. The BFSI sector is expected to maintain a significant market share due to its high volume of financial transactions and the critical need for real-time cash visibility. The IT and telecommunication sector, on the other hand, is experiencing substantial growth as companies prioritize optimizing cash flow management and mitigating financial risks in a volatile market environment. Additionally, the healthcare sector is increasingly turning to treasury software solutions to streamline revenue cycle management and adhere to regulatory requirements, thereby contributing to market expansion.

Overall, the Latin America treasury software market presents a promising landscape characterized by technological advancements, increasing digitization, and the continuous pursuit of efficient financial management solutions across industries. With key market players driving innovation and competition through strategic initiatives and product enhancements, the market is poised for significant growth and transformation. The relentless focus on providing advanced treasury software solutions tailored to the diverse needs of organizations in Latin America is expected to result in a more streamlined and optimized financial ecosystem in the region.

The Latin America Treasury Software Market is highly fragmented, featuring intense competition among both global and regional players striving for market share. To explore how global trends are shaping the future of the top 10 companies in the keyword market.

Learn More Now: https://www.databridgemarketresearch.com/reports/latin-america-treasury-software-market/companies

DBMR Nucleus: Powering Insights, Strategy Growth

DBMR Nucleus is a dynamic, AI-powered business intelligence platform designed to revolutionize the way organizations access and interpret market data. Developed by Data Bridge Market Research, Nucleus integrates cutting-edge analytics with intuitive dashboards to deliver real-time insights across industries. From tracking market trends and competitive landscapes to uncovering growth opportunities, the platform enables strategic decision-making backed by data-driven evidence. Whether you're a startup or an enterprise, DBMR Nucleus equips you with the tools to stay ahead of the curve and fuel long-term success.

Key Influence of this Latin America Treasury Software Market:

- Comprehensive assessment of all opportunities and risk in this Latin America Treasury Software Market

- This Latin America Treasury Software Marketrecent innovations and major events

- Detailed study of business strategies for growth of the this Latin America Treasury Software Market leading players

- Conclusive study about the growth plot of the Market for forthcoming years

- In-depth understanding of this Latin America Treasury Software Market particular drivers, constraints and major micro markets

- Favorable impression inside vital technological and market latest trends striking this Latin America Treasury Software Market

- To provide historical and forecast revenue of the Latin America Treasury Software Marketsegments and sub-segments with respect to four main geographies and their countries- North America, Europe, Asia, and Rest of the World (ROW)

- To provide country level analysis of the Latin America Treasury Software Market t with respect to the current market size and future prospective

Browse More Reports:

Global Passion Fruit Market

Asia-Pacific Bladder Cancer Diagnostics Market

Global Positron Emission Tomography (PET)-Computed Tomography (CT) Scanners Market

Global Driving Protection Gear Market

Global AI Market

Global Diaper Packaging Machine Market

North America Closed System Transfer Devices Market

Global Investment Casting Market

Global Jute Bag Market

North America Rowing Machines Market

Global Morton’s Neuroma Treatment Market

Global Wood and Laminate Flooring Market

Global Propylene Market

Middle East and Africa Pharmaceutical Vials Market

Global Alzheimer’s Disease Market

Global Floor Cleaning Equipment Market

Global Diet Candy Market

Asia-Pacific Polymerase Chain Reaction (PCR) Multiplex Assays Market

Middle East and Africa Functional Mushroom Market

Europe Customized Premixes Market

Global Polyvinyl Chloride (PVC) Compound Market

Asia-Pacific Wound Debridement Devices Market

U.S. Hemostats Market

Global Electroencephalography Devices Market

Global Bovine-Based Collagen for Biomedical Applications Market

Global Architectural Paint Oxide Market

Global Enterprise Asset Management Market

Global Intermediate Bulk Containers (IBC) Rental Business Market

About Data Bridge Market Research:

An absolute way to forecast what the future holds is to comprehend the trend today!

Data Bridge Market Research set forth itself as an unconventional and neoteric market research and consulting firm with an unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process. Data Bridge is an aftermath of sheer wisdom and experience which was formulated and framed in the year 2015 in Pune.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email:- corporatesales@databridgemarketresearch.com